Exclusive Access

We connect investors to pre-market blockchain, AI, and green energy projects, backed by deep market intelligence.

Brecht Invest is a private hedge fund specializing in exclusive cryptocurrency ventures, STO projects, and technology-driven assets — opportunities unavailable to the public market.

We connect investors to pre-market blockchain, AI, and green energy projects, backed by deep market intelligence.

Our precision investment models are designed to protect and grow capital in high-potential, high-security environments.

We are a private hedge fund specializing in exclusive cryptocurrency ventures, STO projects, and tokenized assets. Our strength lies in accessing off-market opportunities and delivering high-return strategies to high-net-worth and corporate investors.

To deliver sustainable, above-market returns by combining exclusive market intelligence with precision investment strategies. We exist to bridge the gap between visionary capital and groundbreaking projects, ensuring our clients gain first-mover advantage.

To be the leading global authority in private market cryptocurrency investments, known for transforming early-stage opportunities into long-term wealth. We envision a future where tokenization, AI, and blockchain redefine how capital moves — and our clients lead that change.

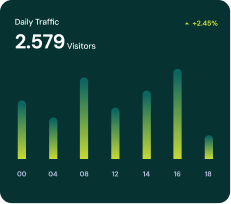

Average annual portfolio increase through exclusive private market access.

Private investments meeting or exceeding projected returns.

EnActive strategies to reduce exposure in volatile markets.

Exclusive access to private cryptocurrency, STO, and tokenized asset opportunities.

Entry into projects shaping blockchain, AI, and green energy markets.

Tailored investment structures aligned with your capital growth goals.

Long-term strategies for stable, compounding portfolio performance.

We identify and secure positions in high-potential STOs, tokenized assets, and blockchain ventures before they reach the public market. Our strategies are built to generate consistent portfolio expansion while safeguarding principal investment.

Through rigorous due diligence, active risk management, and diversification across resilient sectors, we protect investor assets from volatility while maintaining exposure to growth opportunities.

We position clients at the forefront of AI, blockchain, and renewable energy projects — accessing innovation early to maximize long-term returns and competitive advantage.

We’ve compiled essential answers to help you understand our approach, the markets we operate in, and how we deliver consistent, risk-managed growth.

Ask usOur advisory connects you to exclusive pre-market investment opportunities across multiple high-growth sectors, including cryptocurrency ventures, Security Token Offerings (STOs), tokenized real estate, AI-driven platforms, advanced smart contract ecosystems, and emerging renewable and infrastructure projects. We deliver tailored strategies, ensuring your portfolio is positioned for long-term capital appreciation while mitigating risk.

We work with high-net-worth individuals, family offices, and corporate investors who seek confidential, high-value opportunities unavailable on public markets. Our clients value discretion, precision execution, and strategic insight when allocating capital into emerging technologies and alternative asset classes.

We measure success using three core metrics: portfolio growth, risk-adjusted returns, and strategic positioning for future market shifts. Our reporting not only tracks numerical performance but also evaluates early access benefits, liquidity advantages, and overall portfolio resilience.

Yes — we operate a fully digital, secure advisory model to maximize efficiency and client convenience. All consultations, portfolio updates, and opportunity briefings are delivered online, using encrypted communication channels to maintain absolute confidentiality.

Our expertise spans private cryptocurrency and blockchain ventures, tokenized commodities, real estate-backed STOs, AI and machine learning applications, decentralized finance (DeFi) infrastructure, and select emerging technology sectors. We continually monitor global market trends to identify and secure the most promising opportunities before they become widely available.